what percentage of taxes are taken out of my paycheck in ohio

Ohios personal income tax uses a progressive tax. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions.

The Ohio bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

. Its important to note that there are limits to the pre-tax contribution amounts. Calculates Federal FICA Medicare and withholding taxes for all 50 states. For employees earning more than 200000 the Medicare tax rate goes up by an additional 09.

A bachelors degree takes a. This tax is also referred to as the Old Age Survivors and Disability Insurance OASDI tax. Supports hourly salary income and multiple pay frequencies.

For starters you can fill out a new W-4 form so that you can adjust your withholdings. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475.

The percentage that is taken out of your paycheck depends on your exemptions and the amount of money you make. For the first 20 pay periods therefore the total FICA tax withholding is equal to or 52670. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

For a single filer the first 9875 you earn is taxed at 10. This can decrease the amount your employer withholds and thus make each paycheck bigger. 124 to cover Social Security and 29 to cover Medicare.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Put Your Check in a Bank. Switch to Ohio salary calculator.

How You Can Affect Your Ohio Paycheck. Why Gusto Payroll and more Payroll. Therefore FICA can range between 153 and 162.

Does Ohio have income tax at the personal level. For 2022 the limit for 401 k plans is 20500. Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck.

Figure out your filing status. This free easy to use payroll calculator will calculate your take home pay. Ohio State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state SUI in full and on time you get a 90 tax credit on FUTA.

A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. If you want a bigger Ohio paycheck there are several steps you can take. Only the very last 1475 you earned would be taxed at.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. For annual and hourly wages. For self-employed individuals they have to pay the full percentage themselves.

Generally around 15 is taken out of each paycheck and held for taxes social. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. SUI tax rates range from 08 to 102.

No only a certain percentage usually 25 of a check. Ohio does not require withholding taxes to be taken out of prize winnings for. Calculate your tax year 2022 take home pay after federal Ohio taxes deductions and exemptions.

The tax applies for the first 118500 of the employees. This 153 federal tax is made up of two parts. If a father owes 514 dollars of child support and his paycheck is 1000 dollars can the entire 514 be deducted from that one paycheck in Ohio.

Calculating your Ohio state income tax is similar to the steps we listed on our Federal paycheck calculator. New employers pay 27 in 2022 and 55 if youre in the construction industry. Automatic deductions and filings direct deposits W-2s and 1099s.

Ohio Hourly Paycheck Calculator. Cost in Ohio If you opt for an associate degree you will be in school for 20 to 30 months and pay as much as 39970. The Ohio bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

The taxable wage base is 9000 for. The rate is at least 35 percent. The state of Ohio takes out 200 dollars.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Newest Checking Account Bonuses and Promotions. Use this paycheck calculator to figure out your take-home pay as an hourly employee in Ohio.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Amount taken out of an average biweekly paycheck. The payroll tax is broken down as follows.

What Is The Percentage Of Taxes Taken Out Of A Paycheck In Ohio. Work out your adjusted gross income Total annual income. These are contributions that you make before any taxes are withheld from your paycheck.

This Ohio hourly paycheck calculator is perfect for those who are paid on an hourly basis. Social Security has a wage base limit which for 2022 is 147000. Only the Medicare HI tax is applicable to the remaining four pay periods so the withholding is reduced to 6885 x 145 or 9983.

Ohio Administrative Code 5703-7-10 provides that withholding agents must withhold at least 35 on supplemental compensation such as bonuses commissions and other nonrecurring types of payments other than salaries and wages. This is out of each pay check. Employers and employees both pay a percentage of the wages towards this tax currently set at a contribution of 62 percent each.

What percentage of taxes is taken out of paychecks in Virginia. Both employee and employer shares in paying these taxes each paying 765. How much does Ohio take out of your paychecks for taxes.

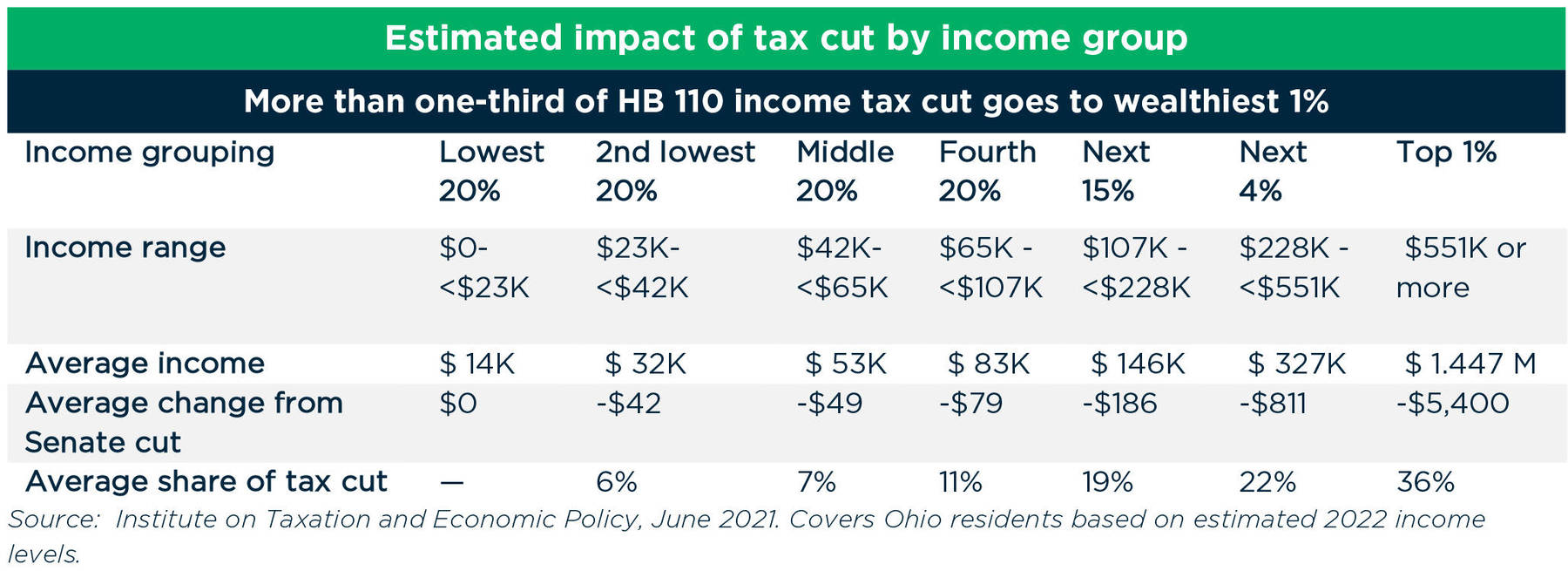

Ohio Tax Cuts Would Go Mostly To The Very Affluent

Employer Withholding Taxability Department Of Taxation

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Ohio Paycheck Calculator Smartasset

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

2022 2023 Tax Brackets Rates For Each Income Level

State Income Tax Rates Highest Lowest 2021 Changes

Take Action Current Federal Minimum Wage Leaves Families Stuck In A Cycle Of Poverty How To Wrench Ourselves Out Of The Minimum Wage Tuition Network For Good

Payroll Tax What It Is How To Calculate It Bench Accounting

Employer Withholding Department Of Taxation

The Breakdown Of Local And State Ohio Taxes

Income Ohio Residency And Residency Credits Department Of Taxation

Ohio Tax Rates Things To Know Credit Karma

What Is Local Income Tax Types States With Local Income Tax More

Taxes On Vacation Payout Tax Rates How To Calculate More

What Is The Federal Supplemental Tax Rate Turbotax Tax Tips Videos